This is the sixth of a series of LinkedIn posts where Stampa & Partners answers the question: “How to leverage a full S/4 Finance implementation for budgeting and legal and management consolidation purposes?”

In this weeks’ post we will discuss the important features of the intermediate activities, Preparation and Consolidation:

Preparation

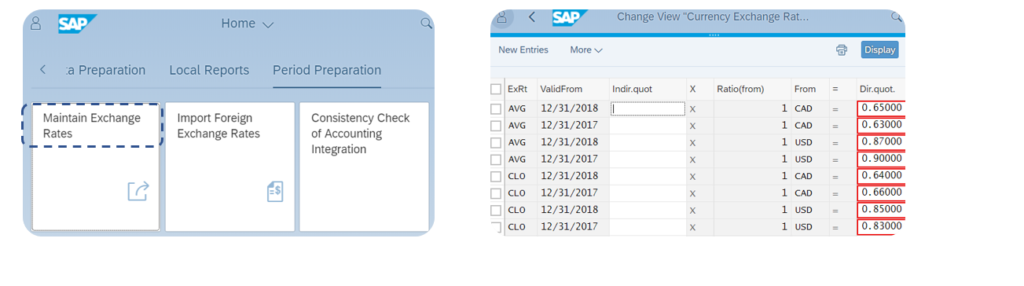

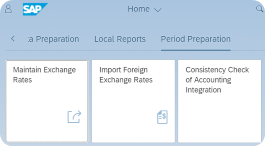

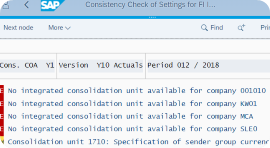

The preparation of the consolidation is the step where finance user assesses the basic information required for consolidation. The tool presents in its tab form a button with the information required to be prepared as “Period Preparation”:

- Maintain Exchange Rates

2. Mapping verification to verify if all accounts were properly mapped from the local to the group CoA:

Consolidation

The consolidation process is the core activity of the SAP Group Reporting tool. Therefore, it comprehends an extensive set of menus and possibilities.

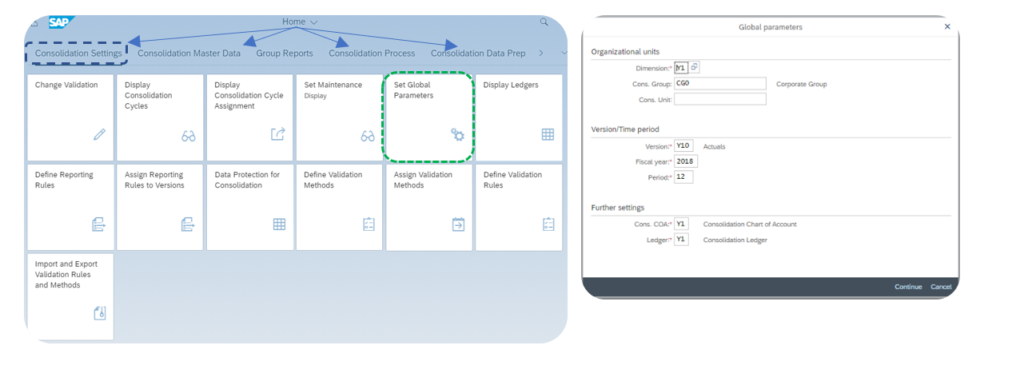

To start with the definition of the consolidation period, in the Consolidation Settings, the user can select to set global parameters to define the period of consolidation:

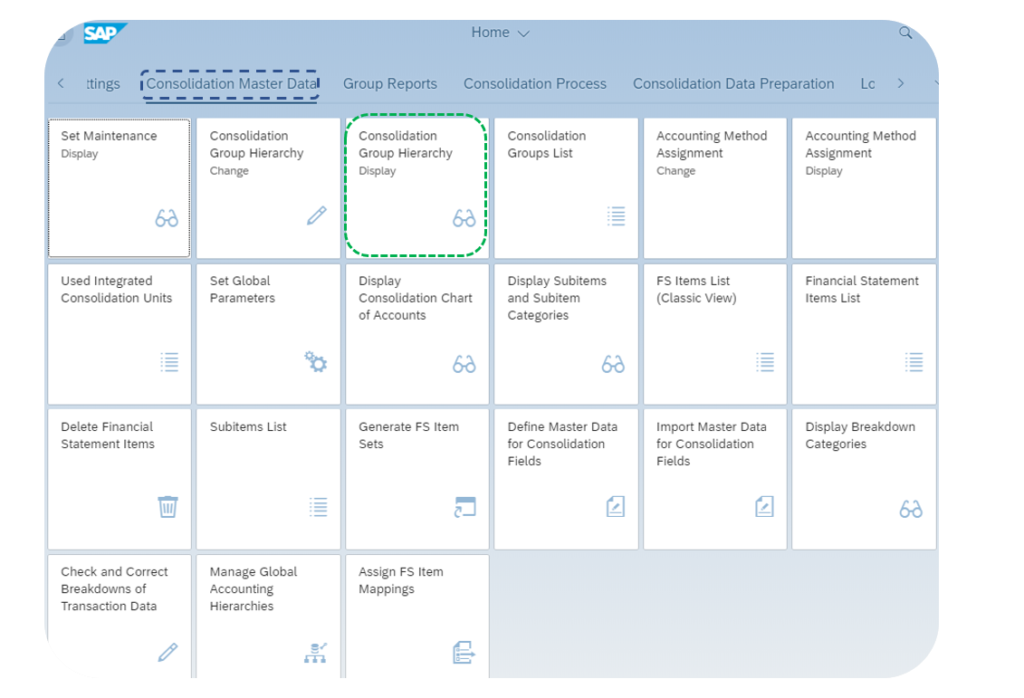

The finance user can also assess the Consolidation Group Hierarchy and the data collection method in place by accessing the Consolidation Master Data menu:

In this menu, it can be defined the consolidation structure by selecting the Consolidation Group Hierarchy Display.

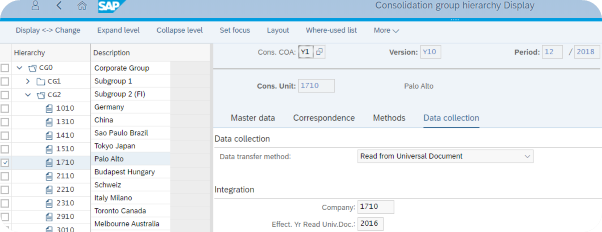

In this menu the user can select the data collection methods for each business entity (e.g. to read the data directly from S/4 or to do it via a load file):

When selecting entity 1710 – Palo Alto, the Data transfer method is set to “Read from Universal Document”. This means that Palo Alto’s data will be read directly from S/4 system.

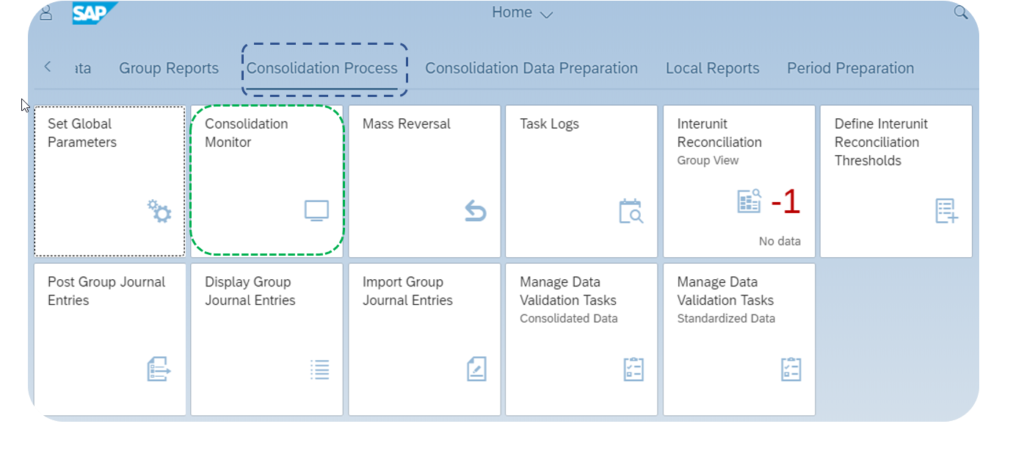

Probably one of the most relevant menus for the finance user is the Consolidation Process. On the menu displayed below it can be seen the relevant activities that can be done:

| 1. | Intercompany (IC) reconciliations; |

| 2. | Post Group Journal Entries (for additional corrections). |

| 3. | Import Group Journal Entries (in case the user has prepared a list of bookings to be performed) |

Also, as it happens for the Data Collection activity, the finance user can access a consolidation monitor:

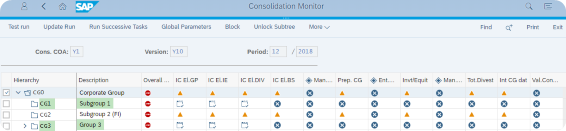

In the consolidation monitor, the user can see:

| • | which are the existent consolidation groups; |

| • | sequential consolidation steps (elimination of IC Gross Profit, elimination of IC Other Income / Expense, elimination of IC dividends, etc); |

| • | status of each consolidation step / activity. |

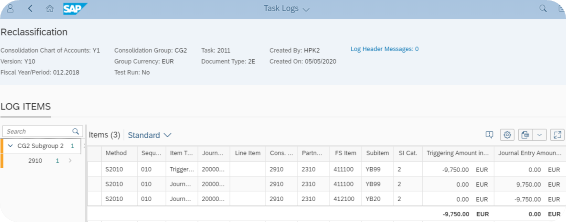

From the menu, the user can then drilldown in each activity to see the postings done by that activity. For example, for the elimination of IC Gross Profit, the tool shows 9’750 Eur, which is the result of a sales between two intercompanies:

This information can be viewed as journals in Group Reporting and can be displayed in reports.

Please stay connected to access next week’s insights on Reporting, our last blog of this series on “How to leverage a full S/4 Finance implementation for budgeting and legal and management consolidation purposes?”.

A new webinar will be schedule later in 2020 so please register in our website or like our page to have notifications on this and other events.

We at Stampa & Partners have an extensive track record working with CFOs and supporting organisations in Europe successfully digitalise finance functions, leverage analytics and ensure compliance with new accounting standards. Therefore, we can advise your business with the best solutions to fulfil your goals.

By André Almeida